Market Update - Mexico in Transition

- Mexico, like many other economies, is navigating a shifting landscape of short-term global economic and financial fundamentals, while also developing longer-term opportunities

- In the short term, the Mexican economy must deal with rampant inflation and a central bank that is committed to fighting that inflation by raising policy rates aggressively

- Latin American equities benefited from the run up in commodity prices, but like other emerging markets have been hit hard by the volatility and uncertainty in emerging market equities this year

- We have upgraded our view of Mexican equities as the combination of attractive valuations and solid but unspectacular growth prospects should be of interest to global investors

- We continue to recommend that equity investors maintain a balance between growth and value and that they look to deploy total return strategies. This should boost returns through dividend yield and buyback strategies

- Given the weakness in Asian emerging markets, we believe the attractive valuations provided in Latin America, and in particular in Mexico, are compelling

Mexico, like many other economies, is navigating a shifting landscape of short-term global economic and financial fundamentals, while also developing longer-term opportunities. In the short term, the Mexican economy must deal with rampant inflation and a central bank that is committed to fighting that inflation by raising policy rates aggressively. Longer term, opportunities exist in numerous areas ranging from energy, food production, and manufacturing. Moreover, Mexico does not suffer from the high levels of political uncertainty that other countries in the region are likely to struggle with over the coming months.

At HSBC Private Bank, we have decided to overweight Mexican equities for several reasons. First, equities in Latin America are trading at historic discounts relative to their emerging market peers. Second, the central bank, Banxico, has tightened policy more aggressively than the US Federal Reserve in order to help combat rising inflationary pressures. The trajectory of policy rates has helped to keep the Mexican Peso steadier than most other EM currencies, which should aid in its fight against inflation. The central bank's actions to fight inflation may prove beneficial as we head towards 2023. Third, the Mexican economy has historically been more directly linked to US economic performance. This should prove beneficial for Mexico as it seems the US economic slowdown should not be as pervasive as in other global regions, providing Mexico with an advantage, especially relative to its peers in the region that are more tied to China. Finally, the nearshoring movement, which has gained momentum with the Biden administration, should provide further upside to the Mexican economy and equity markets across multiple sectors in the not too distant future.

Mexican equities: a relative game

Mexican equities have suffered from volatility like other global markets. In Latin America, equity markets continue to trade at more than 25 per cent discounts relative to their historic averages. While that is true in Mexico, other markets like Brazil and Chile are trading at much greater discounts relative to their historical averages. Moreover, economists forecast that other countries in the region could see a peak in inflation and policy rates faster than Mexico.

On the other hand, Mexican equities have drivers that could provide more consistent returns relative to regional peers. First, some of the other equity markets in the region have tied their fortunes more directly to China. Forecasts for growth in China for the next 18 months are modest at best and well below the targets set forth by the government. Second, the Mexican economy and central bank are more linked to the US economy and markets. While economic growth in the US was officially negative in the first half of the year, forecasts for the balance of this year and 2023 look relatively benign. Significantly, underlying demand and strength of the labor market remain visible. Most economists suggest growth in the US will remain around trend but the economy should avoid outright recession. Solid wage gains and a historically low unemployment rate should enable consumers to maintain steady consumption, albeit at a slower pace and discounted prices. Third, the Mexican central bank has raised rates aggressively and along a similar trajectory as the US Federal Reserve. This has maintained stability for the currency. While the US Fed is not done raising rates, it seems that much of the heavy lifting is behind it and future Fed tightening policy could be less hawkish. This could provide solace to markets and maintain somewhat of a cap on longer-term interest rates, which could be positive for equities. Finally, other countries in the region are in the midst of political turmoil, elections, and constitutional reform. While Mexico is not a political oasis of stability, on a relative basis, localized risks seem more manageable and familiar.

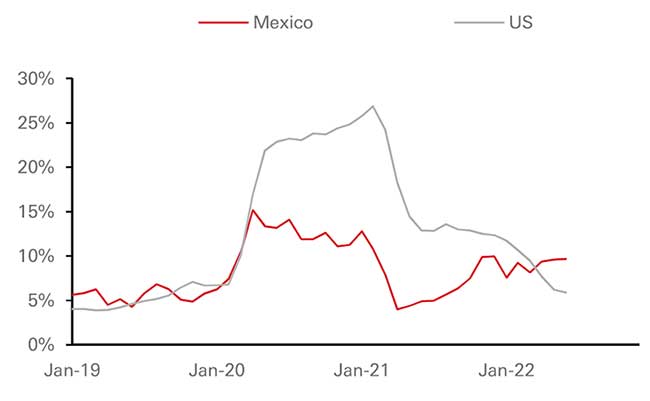

Monetary growth has been more stable in Mexico

M2: Y-o-Y % change

Source: Bloomberg, HSBC Global Private Banking as at 25 August 2022.

Opportunities & proximity

Mexico is a participant in several sectors where supply remains constrained, demand is fairly inelastic, and pricing power and margins can be maintained. Two of those sectors are food and energy. In addition, Mexico is a major manufacturing partner to the US, and bilateral trade agreements such as USMCA, will continue to provide Mexico with advantages. In the financial sector, the normalization of interest rates should enable companies in the sector maintain margins and potentially expand profitability.

In the agricultural sector, Mexico's Ministry of Agriculture & Rural Development noted that in the first half of 2022, Mexican agricultural trade with the US increased by 16 per cent compared to the same period last year. Exports to the US rose 18 per cent while imports from the US increased 13 per cent during the period. Mexican food trade with the US resulted in a USD10.1 billion surplus balance which jumped 24 per cent from the first half of the year in 2021. The agricultural sector remains well positioned and with global supply constraints remaining, should remain quite profitable as well.

The Covid pandemic and recession resulted in tremendous pent up demand and supply chain disruptions. As a result, many American corporations have decided to begin the process of nearshoring. Moving production closer to end-users could make sense for some sectors and companies, as it eliminates long shipping routes that may be sensitive to global disruptions. Other considerations are actually proving more structural, such as geopolitical risk, higher shipping costs, and the issues surrounding immigration and local Job creation. This would move supply chain logistics to the domestic market or to partners who are closer in proximity. Mexico would clearly stand to benefit greatly from this trend, especially given its advantages in terms of lower labor and transportation costs, and its proximity to the US market. In the short term, industrial conglomerates and auto parts producers would likely benefit most directly. In addition, industrial warehouses and logistical distribution companies with a presence in border states could feel a more immediate impact. In the medium to longer term, we expect this effort to expand meaningfully, with Mexico as a key potential beneficiary.

Over time we would expect companies in sectors as varied as technology, vehicle production & parts, basic manufacturing, medical equipment, and household appliances to expand efforts to relocate manufacturing facilities to a more productive, profitable, and proximate base like Mexico. Globally, manufacturing exports remain quite strong, especially to large end user markets like the US, Europe, and China. The US remains the largest importer of manufactured goods, as it alone was responsible for 15 per cent of total global manufacturing imports from 2018-2020, with around 25 per cent of this sourced from China and around 15 per cent from Mexico.

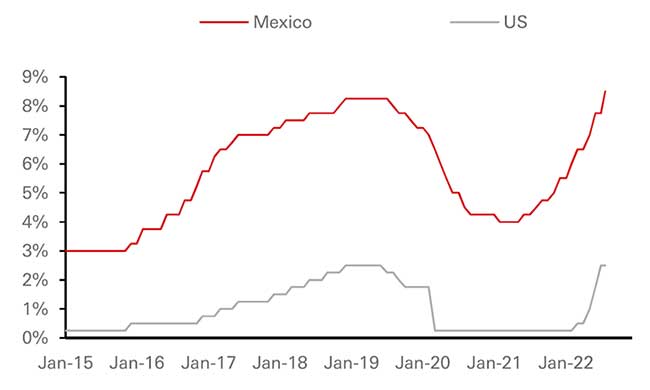

Both central banks have been tightening aggressively

Central Bank Policy Rates

Source: Bloomberg, HSBC Global Private Banking as at 25 August 2022.

Banxico, inflation & the currency

The central bank of Mexico, Banxico, has kept to its policy of tightening monetary policy in a synchronized manner with the US Fed. Banxico remains committed to fighting inflation. It has raised policy rates consistently from a trough of 4.0 per cent in February 2021. In August, it hiked its policy rate by 75 basis points to 8.50 per cent in a unanimous decision. This was in line with market consensus forecasts and the US Fed. Significantly, with its latest hike, the Mexican central bank has raised its policy rates 450 basis points from the most recent trough, which is more aggressive than the US Fed's tightening policy of 250 basis points. This tightening policy signals a serious desire to fight inflation and defend the currency. The Mexican Peso has been the best performing currency in the region, especially against the US dollar. This has not been easy as the US dollar typically rises and has risen during turbulent economic times.

Looking ahead to 2023, HSBC believes there is room for the currency to strengthen. Some of the issues surrounding higher inflation, slower growth, a slower moving US Fed, and a solid balance of payments picture suggest the MXN could be a standout currency in emerging markets and the region.

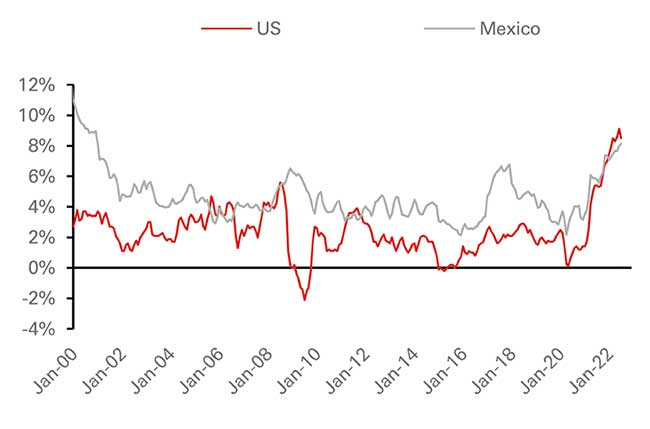

As in many other countries, inflation has been on the rise in Mexico in the post-Covid economic recovery. Mexican inflation has risen rapidly, troughing at 2.2 per cent in the spring of 2020, but posting an 8.0 per cent year-on-year growth rate in June 2022. This is the fastest rise in inflation since 2001. Given domestic and global forces, headline and core inflation expectations continue to show that the convergence to the 3 per cent target will most probably be delayed until 2024.

In the US, the NY Fed posted a study "How much did supply constraints boost US inflation?". The Fed's analysis was that 60 per cent of the Jump in US inflation during the 2019-2021 period was due to pent-up demand and the overall stronger demand for goods. The remaining 40 per cent was due to supply-side issues and logistical constraints, that ended up magnifying the impact of the higher demand. The Fed report concluded that US inflation would have peaked at 6 per cent instead of 9 per cent without the supply bottlenecks. Clearly, that type of analysis can be applied in other countries. Therefore, slowing global demand should reduce supply constraints and tighter monetary policy in the form of higher policy rates and slower growth in monetary aggregates, should help tame demand. That confluence should help contain inflation in the next few years.

Inflation has accelerated in both the US & Mexico. Slower growth may help slow demand and supply disruptions

CPI: Y-o-Y % change

Source: Bloomberg, HSBC Global Private Banking as at 25 August 2022.

Investment Summary

Globally, the asynchronous business cycle continues. In countries like the US and Mexico where the central bank is fighting inflation by aggressively raising policy rates, equity markets have remained particularly volatile. Given the hawkish policies already enacted, future tightening will likely be less aggressive. Moreover, in both countries inflation may be peaking, and interest rates in those markets may provide some solace to equity investors.

Regionally, Latin American equities benefited from the run up in commodity prices, but like other emerging markets have been hit hard by the volatility and uncertainty in emerging market equities this year. We have upgraded our view of Mexican equities as the combination of attractive valuations and solid but unspectacular growth prospects should be of interest to global investors. This is especially true given prospects for growth and profitability in other global markets.

We continue to recommend that equity investors maintain a balance between growth and value and that they look to deploy total return strategies. This should boost returns through dividend yield and buyback strategies. Given the weakness in Asian emerging markets, we believe the attractive valuations provided in Latin America, and in particular in Mexico, are compelling. While Mexico's discounted valuations are not as deep as some of its regional peers we feel the stability of growth and earnings, given its relationship with US economy and markets, is a positive. In addition, relative political stability and the potential for expanding its manufacturing base through an expansion of nearshoring and manufacturing exports to the US provides Mexican exports and equity markets with further upside potential.

/banner-2023/HSBC%20Global%20Private%20Banking%20-%20Aerial%20view%20of%20the%20dry%20Orto-Tokoy%20reservoir.jpg)