Market Update - The Fed balancing risks and responsibilities

- For the fourth time in a row the Fed raised the policy rate by 0.75 per cent, unanimously and as expected, to 3.75-4 per cent. Chair Powell indicated that the destination of rates may be higher than previously projected, because of a strong labour market and sticky inflation. We thus raise our peak rate forecast by 0.25 per cent: at the December meeting we still expect them to raise rates by 0.50 per cent, but for February we now expect them to raise rates by another 0.50 per cent (vs 0.25 per cent previously), leaving the target range at 4.75 - 5 per cent.

- The Fed's tricky balancing act consists of tightening policy sufficiently to slow demand and inflation, while not pushing the economy over into recession, though they are willing to see a sustained period of below trend growth to crush inflation. The official press release included new verbiage that suggests the FOMC may soon downshift policy into a slower gear. The Committee suggested it "will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments".

- This suggests to many that the Fed may be nearing a point where they pause and reflect on how the economy and financial markets are responding. At the same time, we believe the Fed will keep interest rates unchanged throughout 2023 and 2024, at a restrictive level, to gradually move inflation back to the two per cent level.

- The Fed meeting was interpreted by markets as being on the hawkish side, hurting risk appetite as markets had arguably become too optimistic about a pivot in recent weeks. That said, the likelihood that we are probably nearing the end of the Fed tightening cycle will start to direct investors' attention more to economic and earnings fundamentals. We remain defensively positioned in our sector choices and differentiate heavily between companies and borrowers.

- In equities, we continue to focus on quality companies that generate cash, earnings, and maintain low levels of debt. In fixed income, higher rates provide selective opportunities and we maintain our focus on investment grade. While the additional 25bp of hikes are a negative for bonds, the higher rates may ultimately slow economic growth further, which is a positive for safe havens. As for USD, the rate differential and relatively more resilient US economy compared to many other DM countries continues to provide the dollar with some support.

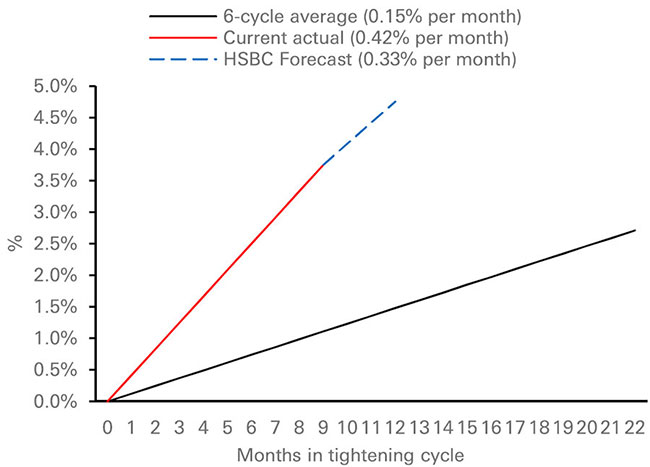

As expected, at its November meeting the FOMC raised the Federal funds rate by 75 basis points, lifting the policy rate to a range of 3.75 - 4.00 per cent. This was the fourth consecutive meeting where the Fed raised rates by 75 basis points and represents an average monthly gain of 42 basis points per month since the Fed began tightening policy rates in March. This continues to be the most aggressive Fed hiking cycle in history, as the FOMC has averaged 15 basis points per month in the six prior tightening cycles.

This is the most aggressive Fed tightening cycle ever

Source: Bloomberg, Federal Reserve, HSBC Global Private Banking as at 2 November 2022.

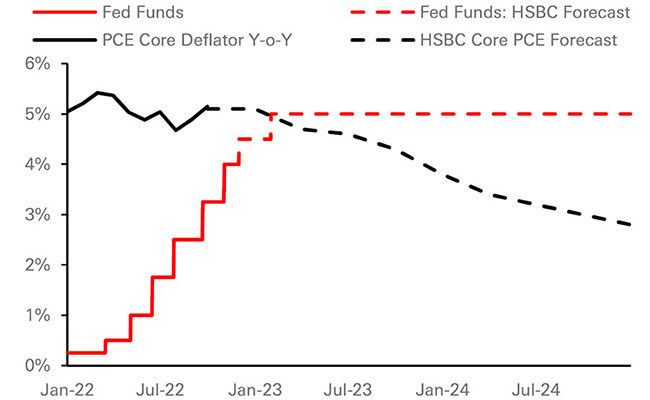

The Fed's balancing act consists of tightening policy sufficiently to slow demand and inflation, while not pushing the economy over into recession. The official press release included new verbiage that suggests the FOMC may soon downshift policy into a slower gear. The Committee suggested it "will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments". Investors thought this sentence could possibly suggest that the FOMC may soon pause or raise rates much more slowly than expected. At the December meeting we expect them to raise rates by only 50 basis points and in February we expect them to raise rates by another 50 basis points, leaving the target range at 4.75-5.00 per cent. In fact, by the end of the day, markets had priced in an 80 per cent probability of a 50 basis point rate hike in December.

The market's enthusiasm from hearing the Fed may soon pause did not last long, though, as during his press conference Fed Chair Jerome Powell made several comments that rankled market participants. First, he warned markets that "the ultimate level of interest rates will be higher than anticipated" in September when the FOMC published its latest Summary of Economic Projections (the so-called 'dots plot'). He then clarified that it is "premature to think about pausing hikes and ongoing increases are likely needed to return inflation to the FOMC's 2 per cent symmetric target".

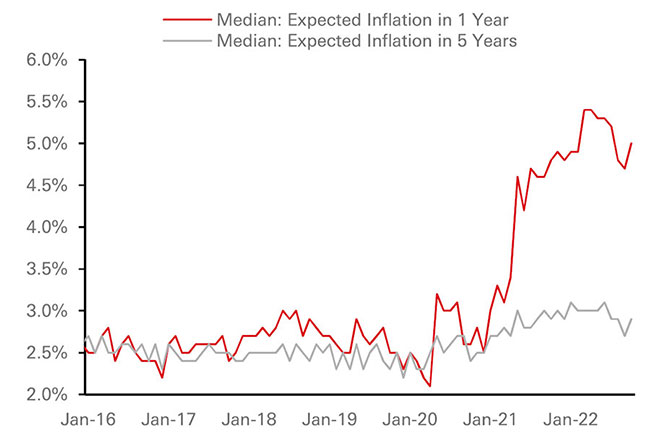

The Fed made it quite clear that they will be aware of the cumulative effect higher rates have had and the lag structures in place. This suggests to many that the Fed may be nearing a point where they pause and reflect on how the economy and financial markets are responding. Fed Chair Powell also made it clear several times that they feel they must maintain a restrictive policy for a "prolonged period of time to ensure that inflation returns to its 2 per cent symmetric target and that long-term inflation expectations remain well anchored". While global issues are not part of the Fed's mandate, it seems clear that the Fed's aggressive policy and the resulting stronger US dollar are having pronounced effects on many economies and financial markets. The Fed will remain vigilant regarding global economic and financial market conditions and the potential feedback loops that could further slow growth and adversely affect markets in the US.

Longer term inflation expectations remain well anchored

University of Michigan inflation expectations

Source: Bloomberg, HSBC Global Private Banking as at 2 November 2022

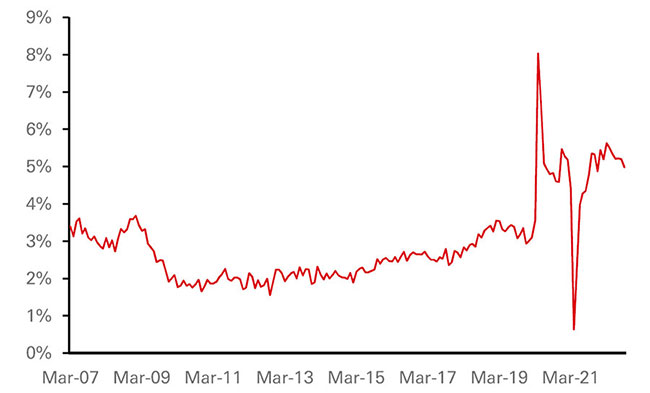

One of the key drivers of inflation has been the faster wage gains we have seen in this business cycle. Average hourly earnings are rising in excess of 5 per cent year-over-year while in the last business cycle they rose an average of 2.5 per cent year-over-year. In addressing the state of labor markets, the Fed Chair said that labor markets remain "out of balance". He pointed out that job gains remain robust and suggested the unemployment rate will have to climb before wage gains may slow sufficiently. Powell even suggested that a "sustained period of below-trend growth and some softening of labor market conditions" may be needed to slow demand and inflation.

Average hourly earnings are slowing

AHE: Total Private Y-o-Y % change

Source: Bloomberg, HSBC Global Private Banking as at 2 November 2022.

Real Fed Funds will turn positive soon

Source: Bloomberg, HSBC Global Private Banking as at 2 November 2022.

Investment Summary

For investors, the Fed's action was not a surprise. However, some of the rhetoric in the press conference has given investors pause. It is possible that the Fed may raise rates more than markets anticipate, but principally, it seems unlikely that we will see material (or any) cuts in 2023 and 2024.

Either way, it is important to remember that we are probably nearer the end of the Fed tightening cycle which will give the markets ample time to analyse the fundamentals of the economy and the financial markets to make appropriate investment decisions.

- In equities, we continue to focus on quality companies that generate cash, earnings, and maintain low levels of debt. We maintain a more defensive posture in our sector selection to that end. In the next few months markets will probably re price equities yet again, this time reflecting the double whammy of slower demand and compressed margins and the resulting downgrade of earnings expectations for the next year. While higher interest rates clearly may take a bite out of equities, US equities should fare better than most markets, even with the potential for slower growth, which is why we maintain our overweight on US equity markets.

- In fixed income, higher rates provide selective opportunities and we maintain our focus on investment grade corporates, as well as emerging market credits. We maintain short duration strategies as higher policy rates should continue to drive market rates higher. If economic growth slows more or if the Fed raises rates higher than expected, investors willseek the security of quality US fixed income markets.

- For the US dollar, the momentum in the drivers of the US dollar bullish trend since mid-2021 (tighter US monetary policy, slowing global growth, and rising risk aversion) are waning but not yet done.

/banner-2022/HSBC%20Global%20Private%20Banking%20-%20Shanghai%20Road.jpg)