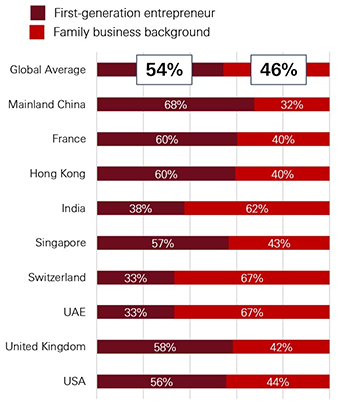

There’s much discussion about first generation wealth, but in mainland China we also see a strong trend for first generation entrepreneurs.

These HNW and UHNW individuals aren’t just the first generations of their family to have significant wealth, they are also the first in their family to have become an entrepreneur.

Mainland China has one of the largest proportions of first-generation U/HNW entrepreneurs in Asia (68%) and, based on our recent survey, the 2023 Global Entrepreneurial Wealth Report*, one of the highest proportions across all the world’s major markets. This leaves a smaller group (32%) who do come from a family business background.

Their businesses are a significant part of their wealth and therefore play a central role in their legacy plans. However, with so many first-generation entrepreneurs, there is likely to be less experience and knowledge of how to transition those businesses as part of the family legacy.

Entrepreneurial background

% of respondents

A new era of family businesses

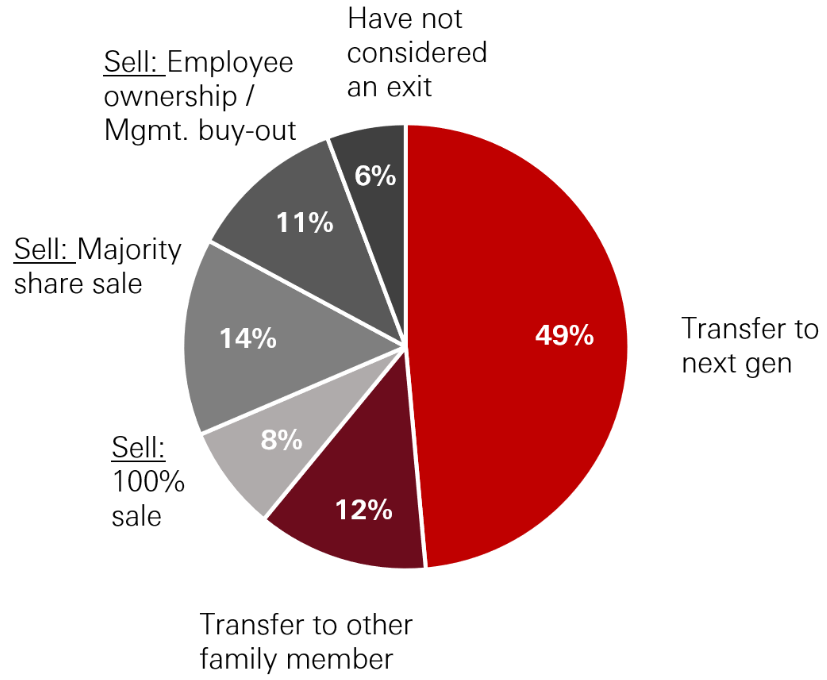

This is perhaps the beginning of a new era of multi-generational family-owned businesses in mainland China with 35% indicating that there are already multiple generations involved in running the business. When it comes to business transitions, 61% are intending to pass ownership of their business onto family members and 33% are looking to sell up.

Regardless of whether the business is kept in the family or if it’s the financial proceeds from a sale, protecting family wealth and ensuring legacy through the generations is an important topic for wealthy entrepreneurs. For those who are the first in their family to have this responsibility it is important to consider this early, and plan accordingly.

Family office, governance and trust solutions have been widely utilised by global entrepreneurs as tools for sustaining their family's legacies. For mainland China’s new generation of family businesses, there is much that can be learnt from peers in Asia and beyond.

One particular group to learn from are those that have already transitioned their businesses. We asked a group of 125 of these entrepreneurs from across the globe who have already transitioned their businesses what they would have done differently or better. Just under half (46%) said they would have consulted more with their family. Their top three recommendations for those preparing to pass on or sell their business were:

- To have a full understanding of the financial value of the company (50%)

- Ensuring you have a full understanding of the process (47%)

- Starting preparations as early as possible (42%)

Plans to exit, leave or hand down a business

% of respondents

Wealth & business transitions

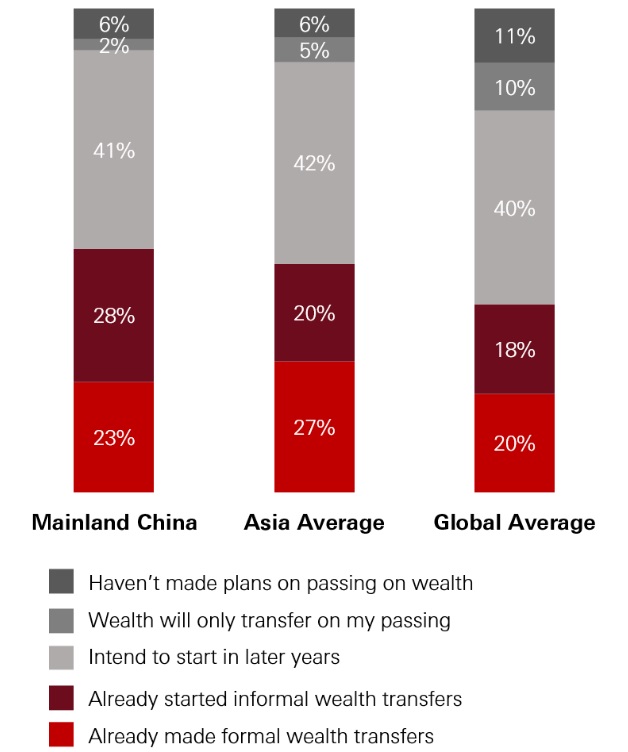

It’s also clear that mainland China’s wealthy entrepreneurs have already started passing on their wealth with 50% having done this either informally or through formal transfers. This is one of the highest proportions we see globally.

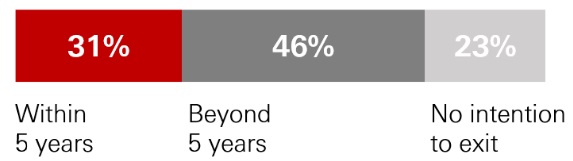

When it comes to their business transitions, just under a third of entrepreneurs in mainland China are thinking of exiting their business within the next 5 years either through succession or selling-up.

So, these transitions have already begun, and the relative success of these legacies are starting to be determined. So how well prepared are families?

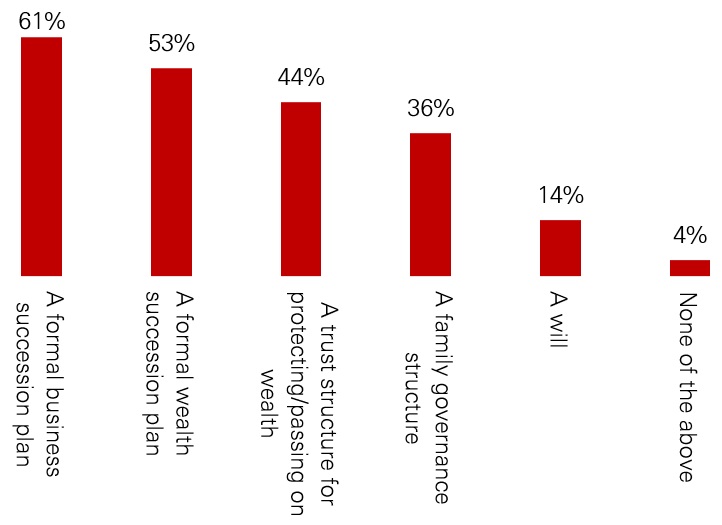

The positive news is that 94% of mainland China’s wealthy entrepreneurs have indicated that they have some level of plan when it comes to transferring their wealth with only 6% saying that they haven’t yet made any plans as yet.

Timing of wealth transfer

% of respondents

Purpose of wealth

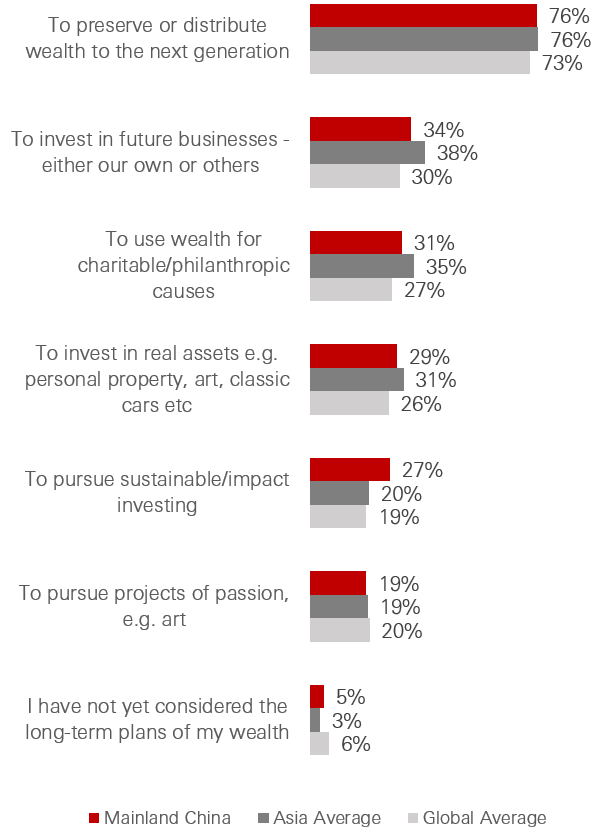

Family is key in mainland China – and so too is preserving wealth for the next generation, with 76% stating this as their intended purpose for their wealth. They are also looking at investing in more businesses – either their own or others (34%). This trend for serial entrepreneurialism may be a key driving force behind the growth in this market – with wealth being used to create more business ventures for the immediate family, but also through the opportunities it creates around it. Whether that’s for local communities, the workforce or even through investments.

They are also looking specifically at where they can have an impact, with 31% planning to use their wealth for charitable and philanthropic purposes, as well as 27% interested in sustainability and impact investing.

And it’s not just their current business they are thinking about. More than half of these entrepreneurs (56%) are looking to stay in business post exit, with 27% planning to pursue mentorship or independent director roles. Only 5% haven’t made plans about what they’d like to do (vs global average 12%).

Purpose of wealth transfer

% of respondents

Talking about wealth succession

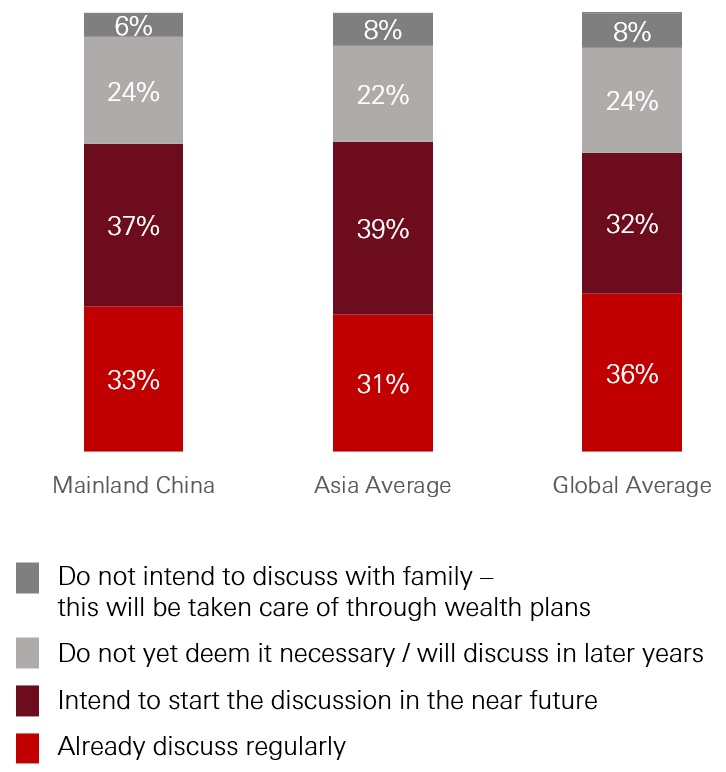

Creating and maintaining a lasting legacy is a priority. We see that 33% are already discussing the wealth transfer process regularly with their families, with 37% intending to start soon. Only 6% don’t plan to discuss it at all, leaving their wealth plans to take care of it upon their passing.

Whilst mainland China’s entrepreneurs are very much in-line with their Asia peers (31%), they are much less likely to be holding regular discussions with their families when compared with the global average (36%). Those in Europe and the US are considerably more likely to be having regular discussions at 39% and 49% respectively.

Perhaps that’s why we see a large proportion of these entrepreneurs with structures in place to help manage this legacy – such as formal business succession plans and wealth structures, trusts and family governance.

Discussing wealth transfer with family

% of respondents

Structures in place for passing on wealth and investments

mainland China

% of respondents

Involving next gen in business and wealth management

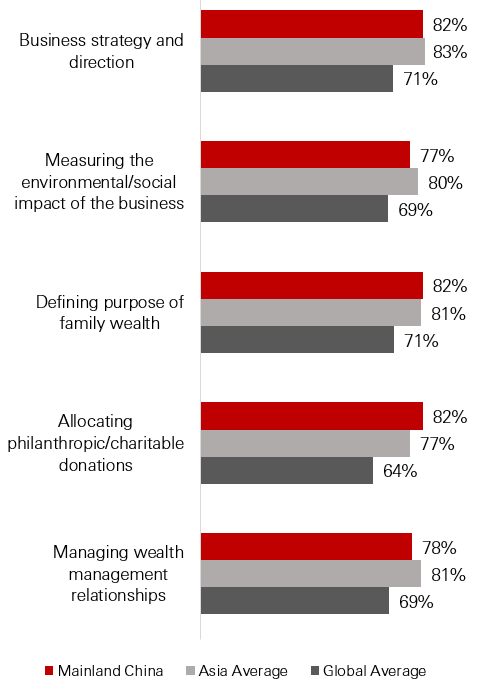

The next generation are already involved or influencing the family business with 82% of mainland China entrepreneurs indicating that the next generation are supporting the business strategy and direction.

The same proportion (82%) are also supporting the allocation of philanthropic or charitable donations from the business or family wealth. Philanthropy can be a useful planning tool for teaching them about wealth and preparation for involvement in the family business. Charitable planning structures can be seeded and funded, and the results provide insight on how prepared the next generation may be for managing the family’s broader wealth and family business.

From a wealth management perspective, more than eight in 10 are influencing or involved in defining the purpose of family wealth, creating alignment of values between generations and helping to set the next generation up for success during, and after, the transfer of the business.

The survey shows how entrepreneurs across Asia, including those in mainland China, are far more likely to be involving their next generation in all aspects of running the business and wealth management than their global peers.

Mainland China is unique when it comes to succession planning as unlike many other markets, this generation of entrepreneurs often only have one successor in their family tree. Which may explain why entrepreneurs here are involving the next generation sooner in all aspects – to bring them into the family business at an earlier stage.

Influence and involvement of the next generation

% of respondents

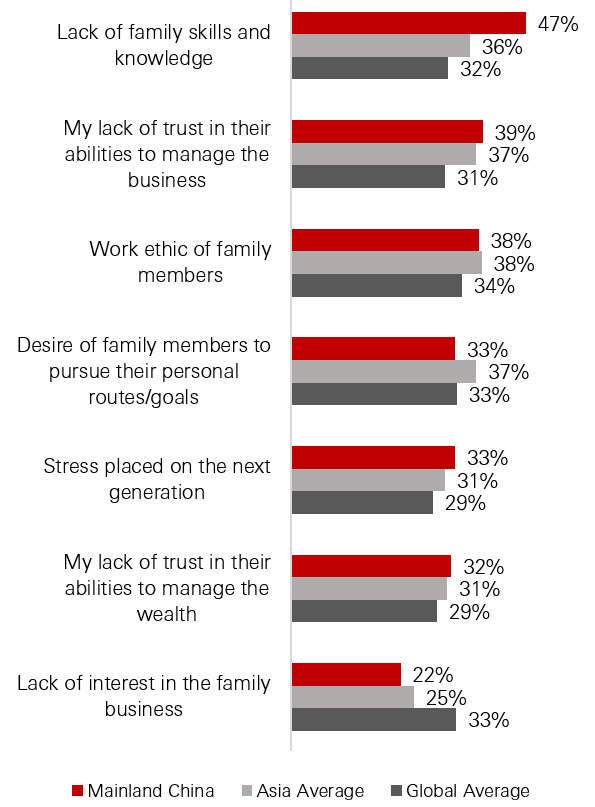

Concerns for the next generation

And while there’s a strong preference for keeping the business within the family, there are concerns for the next generation. A lack of skills and knowledge is cited as the top reason (47%), which could be due to the current generation having built the business up in recent years, rather than coming from a longstanding family business background. This appears to be a greater concern in mainland China than across the rest of Asia (36%).

This also likely explains why a lack of trust in their ability to manage the business is the second most cited concern (39%) followed by the work ethic of family members (38%).

Educating them in the business early on is a clear priority for these entrepreneurs. We often see structures in mainland China which are somewhat unique – with greater emphasis placed on ensuring the next generation have senior management positions or board seats well ahead of the transfer.

Concerns for the next generation

% of respondents

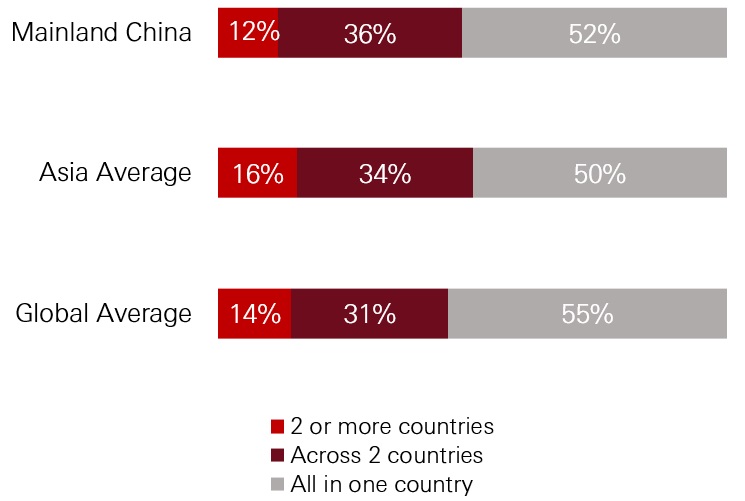

Ensuring legacy across borders

Entrepreneurs in mainland China are international by nature, with almost half (48%) having families in more than one market. And they are looking beyond their borders when it comes to their businesses, too. More than half (53%) of entrepreneurs in mainland China see Europe increasing in importance in the next 3-5 years. They also note Southeast Asia (38%), Middle East (30%) and North America (28%) as a focus, and East Asia, Africa and India as less of a priority. And this isn’t surprising when we look at what’s taking them outside of their market. Wanting what’s best for their children means that education is a huge focus, and often this means sending them overseas to study (50%).

But with more dispersed families and businesses, management of the wealth on a day-to-day basis is also harder. Multi-jurisdictional wealth structuring and long-term estate planning can be complicated, and a holistic view is needed.

Families across borders

% of respondents

Europe, Southeast Asia, the Middle East and North America are of increasing importance

Conclusion

The business landscape in mainland China is changing – driven by a surge in first generation entrepreneurs who are creating and driving international businesses at home and across borders. The great wealth transfer will be particularly pronounced over the next decade and for many in mainland China, this will be a completely new process – and potentially a big learning curve.

Having open conversations and a shared vision can ensure your business and the next generation are set up for success. A robust and well thought out plan can ensure the wealth you have worked so hard to build is protected for many generations to come.

*We surveyed 973 entrepreneurs across 9 markets with investible assets of USD2-100m+ to understand their priorities, concerns and plans in three key areas: international opportunities, the path to business exit and beyond, and the transfer of wealth through generations. This includes 127 respondents from mainland China.

Global Entrepreneurial Wealth Report

What are the themes of wealth management for International Entrepreneurs? What is their perspective when it comes to succession? Find out more from our first Global Entrepreneurial Wealth Report.

/images-2023/HSBC%20Global%20Private%20Banking%20-%20Balkan%20Mountains,%20Bulgaria.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)

Exit on the horizon: Setting up for success

There is always a lot of conversation about starting a business – the ‘start-up’. However, there is less discussion about what happens at the other end.

/images-2023/HSBC%20Global%20Private%20Banking%20-%20Office%20Window.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)

The unorganised state of Ultra High Net Worth wealth

Are the UHNW really less prepared for wealth transfer than everyone else?

/images-2023/HSBC%20Global%20Private%20Banking%20-%20Cityscape%20image%20of%20Mumbai.jpg/_jcr_content/renditions/cq5dam.web.1280.1280.jpeg)

India's Wealth & Entrepreneurial spirit

Are India’s wealthy individuals the most entrepreneurially minded in the world and what does it mean for how they manage their wealth?

/banner-2022/HSBC%20Global%20Private%20Banking%20-%20Guangzhou%20tower.jpg)