Over the next couple of decades, more than USD100 trillion of global wealth is expected to pass from one generation to the next, an unprecedented shift that gives wealth creators the chance to shape enduring legacies.1

Yet even as these wealthy individuals concentrate on building their fortunes, many remain uncertain about what they want their wealth to achieve after they are gone, despite a desire for their legacy to reflect their values.

Those who fail to set out a clear plan face the risk of family conflict, missed opportunities and the erosion of their fortunes as the Great Wealth Transfer unfolds.

Guiding values

And it’s not just their financial assets that could be lost over time, but non-financial wealth. In a HSBC Private Bank global survey of 1,000 wealthy individuals, nearly three quarters (72 per cent) said their legacy is defined more by the passing on of their values than their financial inheritance. Over half (53 per cent) also prefer not to call what they have “wealth” at all, suggesting a desire to define legacy in more personal terms.

When it comes to creating a family legacy, a wealthy individual needs to be guided by two key principles. First, they need a clear set of intentions for their wealth – a wealth philosophy. Second, it’s vital that there is a clear communication of those plans.

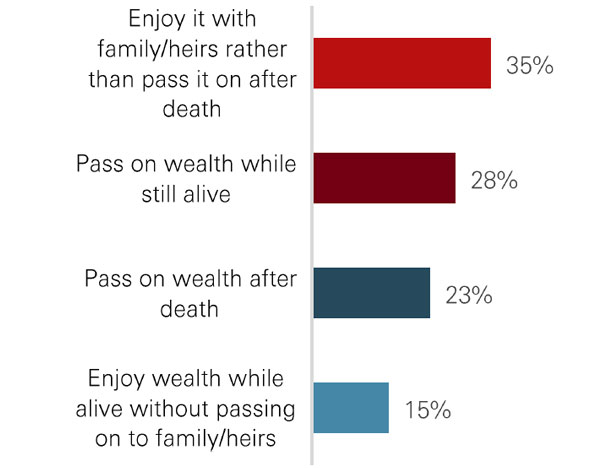

The survey indicates there is no single route for how the wealthy want to spend or pass on their wealth. One third (35 per cent) want to enjoy it with their family rather than pass it on after their death. Just over a quarter (28 per cent) want to pass it on while alive, and less than a quarter (23 per cent) plan to do so after their death.

Regional differences also emerge. Respondents in the US (35 per cent) and UK (33 per cent) were at least twice as likely to say they will transfer wealth after death than those in India (11 per cent), the UAE (14 per cent) and Singapore (19 per cent). Wealthy individuals in these markets were more likely to want to enjoy their wealth rather than pass it on.

Conflicting aims

Prior says many wealth creators often have conflicting objectives, as they have yet to decide what their wealth is ultimately for. “Many are so busy creating their fortunes that they have under-invested in preparing the next generation,” he says.

“What is needed is a clear, well-developed wealth philosophy, involving a much wider set of considerations, than just setting out plans for your financial assets,” he says. Prior says that such a philosophy should identify the purpose of their fortunes, the family members who might benefit, and, fundamentally, the values that the senior generation hold dear and wish to preserve for the future.

Planning a legacy

How wealthy individuals plan to spend or pass on their wealth*

Engaging the family

Defining a shared purpose across generations requires more than goodwill. It demands early and open engagements.

But conversation can be difficult when some parents lack confidence in their children’s readiness to manage wealth. The survey reflects this as more than two thirds (70 per cent) want to delay transferring their wealth to help instil financial responsibility into the next generation.

“Wealth brings freedoms and a lot of convenience, but at the same time, the senior generation know there are also many responsibilities,” says Ann Ling, Head of Wealth Planning and Advisory, Asia Pacific.

Similarly, the children can also feel pressure from that burden of expectation, as they are often worried about making mistakes. As their parents have often been so successful in business and creating wealth, they often feel they are unable to measure up.

This is why strong communication channels between generations are crucial. “From my experience, I've never seen people complain about having the family discussion too early,” Ling says. “To achieve a lasting legacy, families need open communication about what they are passionate about and can unify around.”

Unifying behind a cause

One way to build unity is a cause that all members can support. Within the Great Wealth Transfer, approximately USD18 trillion is expected to go to good causes.1

“Philanthropy can be a powerful way to create a legacy that can last long after the wealth creator has gone, and which can simultaneously unify the family,” says Prior.

“Combining aligned philanthropic values with good planning gives a legacy relevance and energy, says Ling. “This will also help to perpetuate harmony in future generations.”

Ultimately, planning ahead is essential. Family members that engage with each other on the purpose and impact of their collective wealth will be well placed to build something enduring.

But failing to do so brings risks that go beyond financial inefficiency: it can create conflict that threatens a lasting legacy.

Creating a family legacy

A wealthy client of HSBC Private Bank had two objectives when it came to setting out their plans for their legacy. An entrepreneur whose fortune was made in Asia, they were driven by a strong desire to leave a lasting impact on their local community. They also wanted to ensure their children’s involvement to foster a shared family purpose. As their philanthropy adviser, we facilitated family discussions to align on vision, and we helped the client establish a philanthropic structure for longevity. This included defining clear giving objectives and a practical model, building their network, and setting up a structure that empowers future generations to continue the legacy.

Media enquiries

Venus Tsang: venus.y.t.tsang@hsbc.com.hk

Darren Lazarus: darren.lazarus@hsbc.com

/uplift-images/banner/glass-building-reflection-texture.jpg)