Asia’s greatest wealth story is approaching a critical juncture. After decades of rapid growth, the challenge is no longer just how to build wealth but how to preserve and pass it on. Without an urgent shift in mindset, families across Asia may find that managing wealth across generations becomes far more challenging than creating it.

Private wealth in Asia is forming faster than anywhere else, often within a single generation and increasingly across multiple asset classes and borders. But the instinct that built these fortunes – fast decisions, deep conviction in specific sectors and founder-driven control – may not be well suited to what comes next.

According to HSBC’s Global Entrepreneurial Wealth Report, a significant number of Asia’s first-generation entrepreneurs have yet to formalise succession plans, engage the next generation in financial decision-making or establish systems to manage cross-border wealth. These gaps are not just administrative. They can lead to concentration, preservation and inheritance risks – which can pose long-term strategic threats.

Concentration remains the most visible. Many portfolios still reflect the sectors that generated the wealth. In Taiwan, semiconductor entrepreneurs frequently invest in other chipmakers. In mainland China, tech founders often fund younger start-ups. These are confident and informed bets but they also entrench risk. When markets rise, such portfolios can outperform. But when conditions change, the lack of diversification becomes a liability.

Extraordinary growth

We’re seeing extraordinary growth in private capital across Asia — but much of it is still closely tied to single sectors, currencies or markets,” says Lok Yim, Regional Head of Global Private Banking, Asia Pacific.

“That level of conviction can deliver remarkable returns, but it also means these portfolios are more exposed when the environment changes. The challenge now is helping families scale from success stories into structures that can absorb complexity and risk.”

Geographic concentration adds to the challenge. Even where families operate globally, their wealth often remains anchored in one jurisdiction or currency. This can limit flexibility at the moments when swift action is most needed.

Preservation is the second issue. In many cases, a single founder remains the primary decision-maker, with little delegation or long-term structure. That can work when portfolios are modest and domestic but becomes far riskier with scale.

“Clients aren’t ignoring the need to plan, they’re just moving fast,” says Yim. “But the bigger the business, the harder it is to steady when conditions change. Without the right structures, even modest shocks — a market downturn, a regulatory shift, or a succession crisis — can cause major disruption.”

Inheritance is the final and often the most underestimated risk. Many heirs remain outside the decision-making circle. They may be highly educated and globally mobile, yet still unprepared to manage the family’s wealth or legacy.

“Inheritance risk isn’t a legal problem — it’s a leadership problem,” says Yim. “Bringing in the next generation early isn’t just about continuity. It’s about credibility. They need time to learn how to lead before they’re expected to.”

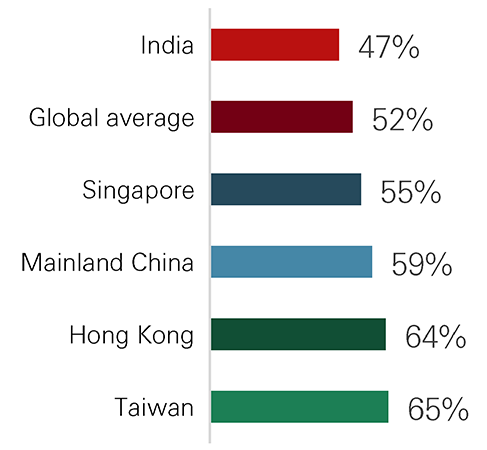

Succession planning

Entrepreneurs with no business succession plan in place

Today’s successors often want to engage with family wealth differently, through ESG, philanthropy, venture capital or more formal governance structures. The earlier they are included, the smoother the transition. When families delay, tensions are more likely to emerge.

Building resilience

“There is a focus and intensity to how wealth is managed in Asia,” says Lavanya Chari, Global Head of Wealth and Premier Solutions. “It’s fast-moving, close to the source and focused on growth. The opportunity now is to convert this intensity into resilience — with strategies that protect what’s been built.”

None of these risks are hypothetical. As the Global Entrepreneurial Wealth Report shows, half of business owners in Asia are concerned about both the financial impact on their family, and what would happen to their business if they were suddenly not around.

Of course, Asia is not one market. Singapore and Hong Kong have more established governance structures. India and mainland China are growing fast, with newer wealth and evolving approaches. South Korea and Taiwan are already facing intergenerational shifts. But across the region, the direction is clear: wealth is expanding rapidly, and the systems to support it must keep pace.

Long-term stewardship

Other regions are watching closely. In contrast to the more institutional models in Europe and North America, Asia’s approach remains highly entrepreneurial: fast, agile and closely tied to the businesses that generated the wealth. That brings conviction and responsiveness. But it also makes long-term stewardship harder to structure.

Asia’s wealth is more concentrated, more mobile and more entrepreneurial than anywhere else in the world. But sustaining that momentum will take more than instinct. It calls for long-term thinking, thoughtful planning and timely action, before growing complexity undermines the sustainability of Asia’s spectacular successes.

Supporting clients with succession

HSBC Private Bank helps clients to not only protect, manage and grow their wealth, but also empower them to pass on their values, vision and impact across generations.

We supported an UHNW family through the transfer of wealth across multiple generations. By establishing trusts and companies, we segregated family business and investment holdings, facilitating better management of financial assets. Recognising the late father’s legacy for giving, we helped establish a charitable trust. We also supported the second generation with planning for their futures, providing the siblings with wealth and succession planning services for their own family branches. |

|---|

Media enquiries

Venus Tsang: venus.y.t.tsang@hsbc.com.hk

Darren Lazarus: darren.lazarus@hsbc.com

/uplift-images/banner/Sunset%20skyline%20Hong%20Kong%20-%20Banner.jpg)