The pursuit of sustainability

We believe the needs of the present can be met without compromising the ability of future generations.

Sustainability is a well-established investment theme. In 1987, a report entitled ‘Our Common Future’ was published by the United Nations. It highlights that “the pursuit of sustainability requires major changes in international economic relations.”

The world’s estimated financial needs for achieving the Sustainable Development Goals are between US$5 trillion and US$7 trillion a year1.

Major changes have taken place, spurred by the UN 17 Sustainable Development Goals encompassing issues such as energy consumption, social justice, biodiversity, and economic growth.

We help clients understand the environmental, social, and governance (‘ESG’) implications of investments, combining their financial objectives with their sustainability preferences. Providing expertise, tools and access to sustainable investment solutions.

Today, sustainable investing is going mainstream, with more investors focusing on generating long-term financial returns while considering the environment and society together.

There is much still to be done. We support our clients on their sustainability journey by providing suitable investment products and solutions, analytical tools and market insights.

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability.

1 Source: UNA-UK, sustainablegoals.org.uk ↩

Sustainability opens up a world of opportunity

Sustainable investing is no longer considered the choice of specialist investors and becoming mainstream. Enjoying recent rapid growth and opening up a world of opportunity for investors who look to benefit from the long-term growth that companies with strong ESG credentials can provide.

HSBC believes the transition to a sustainable economy is a multi-decade investment opportunity

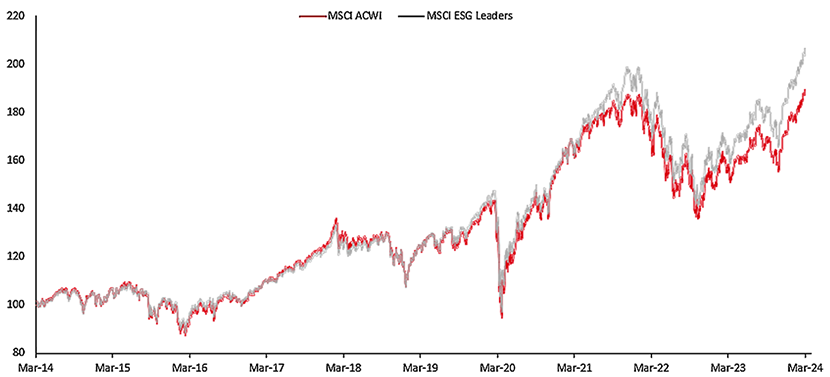

When we talk about performance, we should look at this both from a short-term and long-term perspective. In the short term, there can be significant style and sector biases which are important factors to consider at different market cycles. Excluding or limiting exposure to oil companies, can lead to temporary under-or outperformance. Growth-style companies involved in the energy transition are often interest rate sensitive. And many sustainability-led strategies have a momentum and quality bias. So we need to be aware of these biases. However, there are ESG leader indices which are agnostic to sector and style and tend to perform in-line with the market - in fact they have shown a mild outperformance vs traditional peers in the medium to long term.

The graph below shows the relative performance of the MSCI ACWI index compared to the MSCI ESG leaders index over the ten-year period to March 2024.

ESG equity index outperformed the wider market

Normalised ten-year performance (rebalanced to 100)

Source: Bloomberg, HSBC Global Private Banking as of March 2024

Past performance is not a reliable indicator of future performance

Foot note:

MSCI ESG Leaders index: The index selects companies that have high ESG ratings relative to their peers in each sector of the parent index. Designed to exclude companies involved in severe controversies.

MSCI ACWI Index is the MSCI All Country World index that is designed to track broad global equity-market performance.

MSCI ACWI ESG Leaders index is designed to represent the performance of companies that have high Environmental, Social and Governance (ESG) ratings relative to their sector peers. ESG Leaders Indexes, as with all MSCI ESG indexes, leverage MSCI’s award winning MSCI ESG Research and ESG Ratings.

The sectors within the index include Information Technology, Financials, Healthcare, Consumer discretionary, Industrials, Consumer Staples, Communication Services, Utilities, Real Estate, Materials and Energy. For more info on country and sector weights, MSCI ESG methodology, please visit www.msci.com.

Integrating ESG in a diversified portfolio

This section is not applicable to clients/prospects serviced by the following booking centres: HSBC Private Bank (Suisse) SA, HSBC Private Bank Luxembourg SA and HSBC Private Bank (Luxembourg) S.A. French Branch

Our sustainable investing approach starts with understanding your financial objectives.

We see three main ways to embed sustainability into an investment portfolio, which can be applied across portfolio allocations:

HSBC ESG Enhanced: Investment products that follow specific ESG criteria

This classification covers:

- single-line instruments whose issuers are considered to better manage ESG risks compared to peers in their sector

- products that aim to invest in, or provide exposure to, issuers who are considered better in their ESG risk management compared to their peers or who are improving in the way they manage ESG risks

Examples:

- An instrument whose issuer has a high ranking MSCI ESG score within its sector (for example, within the top 20%). However, this excludes any issuer that (i) has a low ranking for either E, S, or G pillar MSCI ESG scores compared with peers in its sector, (ii) is involved in significant controversies or (iii) does not align with certain recognised sustainability principles (such as the UN Global Compact principles

- An instrument whose issuer has set sustainability targets, for example science-based targets to reduce emissions with the objective of limiting global warming to 1.5 degrees Celsius and has achieved significant completion on decarbonisation targets

- A sustainability-linked bond the return on which is tied to predefined issuer- level sustainability targets

- A fund that excludes issuers towards the lower end (by way of example, the bottom 20%) of its investment universe that is measured by reference to selected ESG metrics (such as MSCI ESG ratings or carbon intensity) relative to their peers

- A fund that aims to invest in a portfolio with a weighted ESG rating (determined by reference to a selected ESG metric, for example MSCI ratings) that is higher than the ESG rating of a reference market benchmark, after excluding those issuers towards the lower end of the benchmark in terms of their ESG scores (for example the bottom 20%)

- A fund that aims to deliver meaningful improvement (for example a 30% or more) in a carbon-related measure compared to a reference market benchmark and with an objective to manage carbon emissions

- A fund with measurable ESG improvement targets for its underlying holdings and an action plan to address circumstances where the improvements are not being achieved

HSBC Thematic: focus on ESG-related growth areas by identifying companies that are aligned to specific sustainable themes

This classification covers investments that provide exposure to ESG- related growth areas and trends that are aimed at resolving specific ESG challenges including:

- single-line instruments whose issuers’ business activities are aligned in whole or part with thematic ESG outputs or operational metrics

- other products that aim to invest in, or provide exposure to, sectors or issuers whose business activities are aligned in whole or part with thematic ESG outcomes or operational metrics

Examples include:

- An instrument

- whose issuer derives a notable percentage (for example at least 20%) of its revenues from products and services that are aligned with an ESG theme, or a theme that references a recognised industry framework like UN Sustainable Development Goals (UN SDGs). Examples of ESG themes are biodiversity, renewable energy, energy transition, gender equity and diversity and

- this excludes any issuer that (i) has a low ranking for either E, S, or G pillar MSCI ESG scores that are compared with peers in its sector, (ii) is involved in significant controversies or (iii) does not align with recognised sustainability principles (such as the UN Global Compact principles)

- A fund that invests majority of its net assets in issuers that derive a notable percentage (for example at least 20%) of their revenues from products and services aligned with an ESG theme

- A fund that invests in issuers with defined and measurable ESG thematic objectives that can be identified and monitored

- A fund with proprietary means of assessing progress against an ESG theme through its investments. This also involves a clear framework, methodology and measurement process against metrics that are strongly aligned with the theme

- A climate change strategy fund that adheres to climate goals in accordance with the Paris Climate Agreement (a 2015 international agreement that aimed at limiting global warming to 1.5% degrees Celsius). This also requires clear articulations on how exposure to this climate theme will be obtained and how the fund’s alignment will be monitored

HSBC Impact*: Investment products that aim to have a direct, positive effect on society, environment, or both. There are clearly pre-defined measurable targets and are subject to periodic reporting

This classification covers investment products that aim to deliver a direct, positive and measurable impact on society and/or the environment including:

- Single-line instruments that raise proceeds which will be used for a particular ESG-related purpose

- other products that invest in, or provide exposure to, issuers or arrangements that aim to deliver forward looking, measurable and positive ESG outcomes

Examples include:

- A green, social or sustainable bond. The proceeds from which are allocated to projects that have a positive effect on the environment or society, like renewable energy projects, pollution reduction initiatives, affordable housing etc

- A fund that invests majority of its net assets in issuers whose products or services aim to generate positive and measurable ESG-related impact. For example, tied to the UN Sustainable Development Goals (UN SDGs) such as combating climate change, achieving gender equality etc

Note: Subject to product availability by markets, for full details please refer to the client pitchbook available for your local markets. *HSBC Impact is referred as HSBC Purpose in UK

To support our clients in their sustainability journey, we offer a full range of ESG, sustainable and impact investing products:

Managed Solutions

Sustainable investing funds, ETFs, discretionary mandates & alternatives investments

Capital Markets

Fixed Income (such as Green, Social, Sustainability, Sustainability-Linked bonds), Equities, Structured Products

Research & Insights

Comprehensive coverage of ESG insights publications

Group Solutions

Access to commercial banking, global markets and asset management capabilities

HSBC Group Industry initiatives

2001

Joined the UK Sustainable

and Finance Association

2006

Signatory to the Principles

for Responsible Investment

2007

Joined Institutional Investors Group on Climate Change

2015

Signatory to the Montreal Carbon Pledge

2017

Launched ClimateAction100+ initiative in collaboration with other investors

2019

Founding member of One Planet Asset Manager Initiative supporting the One Planet Sovereign Wealth Fund Working Group

2020

Founding signatory of the Finance for BiodiversityPledge

2021

Founding member of Finance to Accelerate the Sustainable Transition infrastructure (FAST- Infra) Signatory of the Net Zero Asset Managers Initiative

HSBC Group Awards & Recognition

HSBC is committed to publishing regularly updated information on its ESG performance. The achievements have been recognised in receipt of awards including:

Best ESG Technology Offering – Private Bank

(Global Private Banker WealthTech Awards 2024)

Best Private Bank for ESG Technology

(PWM Wealth Tech Awards 2024)

Winner of Impact Investing – Private Bank (Pan-Asia & Greater China)

(WealthBriefingAsia & Greater China Awards 2024)

Most innovative ESG offering by a Private Bank

(Global Private Banking Innovation Awards 2024)

Best for ESG Investing in Taiwan

(Asiamoney Private Banking Awards 2023)

Best bank sustainability offering (investments)

(WealthForGood Awards 2023)

Best ESG private bank in Hong Kong

(Asset Asian Awards 2023)

ESG Investing Product/Services Excellence Award

(Bloomberg Bizweek 2022, 2023)

HSBC Global Research

Award winning Climate Change Centre of Excellence since 2017

‘Middle East’s Best Bank for Sustainable Finance’

(Euromoney, 2019, 2020, 2021)

Improved MSCI ESG rating to AA

(‘ESG Leader’, recognising our strong corporate governance and commitment to sustainable finance 2021)

‘Asia’s Best Bank for Sustainable Finance’

(Euromoney, 2019, 2020, 2021, 2022, 2023)

Glossary list

Environmental

Environmental refers to the natural world, and includes matters related to Climate (net zero, transition risk, physical risk) and Nature (natural capital, ecosystem services and biodiversity).

Governance

Governance refers to a set of rules and principles defining and the management and oversight of a company. It can be used interchangeably with corporate governance.

Social

Social refers to the consideration of people and relationships, and includes Human Rights and Labour Standards.

Sustainability

Sustainability is a broad term that refers to the ability of an activity, practice, or entity to meet the needs of the present without compromising the ability of future generations to meet their own needs. Environment, Social and Governance (“ESG”) are the three main dimensions of sustainability.

Sustainable Development Goals (SDGs)

Seventeen goals set by the UN that set out all of the things that need to be achieved to protect the planet and ensure that all people enjoy peace and prosperity.

/banner-2021/HSBC-Private-Banking---Cross-sea-Bridge-in-Dalian.jpg)

/banner-2021/HSBC-Private-Banking---Modern-Agriculture.jpg)