Private equity can offer investors a number of strategic advantages. Here’s why you should consider it as part of a diversified portfolio.

by Sophie Ward

‘Private equity’ can be a daunting term for investors. However, we explore why investing in private equity could become your organisation’s strategic secret weapon.

Diversifying your portfolio and allocating a larger amount to private equity, could be a great solution to meeting your charity’s long-term investment needs by taking advantage of illiquidity.

How private equity works:

- Private equity represents share ownership or interest in an entity that is not publically listed or traded

- You invest using a specialist manager, who raises a fund with a set strategy and target fund size e.g. Impact Investing or Technology

- Capital is raised from investors, and is deployed over the next few years into acquisition and value add opportunities

- The company acquired is then often re-capitalised or sold through a trade sale or public offering

- Investing in private equity is a long-term approach, in line with the strategic direction of the firms acquired (typically 10 years), often referred to as ‘patient capital’

Private equity is often expected to achieve higher returns than public equity markets, making it attractive to large-scale investors looking to solve long-term return requirements. Despite this, many UK charities have not traditionally included private equity within their portfolios due to concerns around lower income yield, illiquidity and increased risk.

However, given the potential return profile and its long-term time nature matching many charities’ perpetual time horizons, our view is that private equity is an asset class that should be considered more broadly across the sector.

A trend prevalent in US endowments has been the increase of alternative investments in portfolios1 (which includes private equity), something which has been slower to come to the UK.

The allocation to private equity averages 23 per cent across US endowments2, a figure which is not reflected across the UK market other than a handful of large organisations. However, analysis indicates that endowments and foundations in the top quartile of performance have a minimum allocation of 15 per cent to private investments.3

The ‘illiquidity premium’ is the expected outperformance of private equity over publically listed equity, due to the value-add initiatives a private equity fund can implement for the investors. As an example of this, since 2012 HSBC Alternative Investments Limited has generated a net internal rate of return of +20.5 per cent for its clients, outperforming global equity markets by over +8.0 per cent p/a.4

For a charity with a perpetual timeframe, this return profile can be attractive.

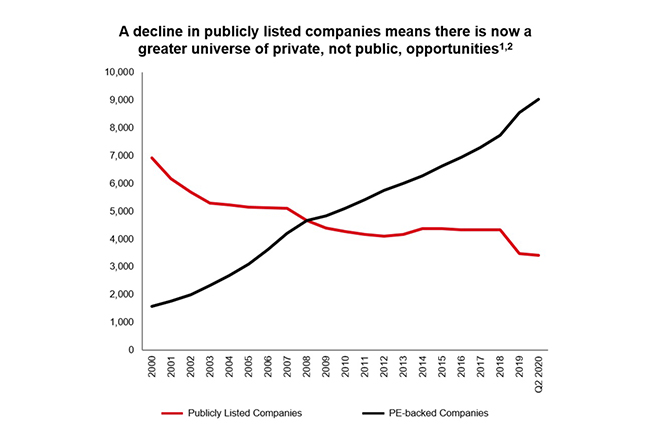

Private markets have grown substantially in recent years to the extent that they are now offering a range of opportunities that are not available in public markets. The number of listed companies in the US has declined by 45 per cent since 1997, meaning that the private company opportunity set for investors has increased significantly.

Source: Adapted from Bridges Capita HSBC Private Banking, Social Impact Investment Taskforce: Asset Allocation Working Group

Source: HSBC, Sources: (1) World Bank Group, (2) PitchBook Data, Inc. as at June 2020. Note: The US market is considered representative

- Returns – Higher upside potential relative to traditional asset classes.

- Timing – Unlike public markets, managers have the luxury of time and timing to drive change and add value

- Exposure – significant opportunities available in non-public markets such as emerging markets and technology

- Risk – Lower valuation volatility than other asset classes during crisis periods

- Access – Now available on a smaller scale, access has changed and is no longer reserved for large scale investors

- Alignment – Investing alongside leading entrepreneurs and sector experts who have significant portions of their wealth in the same fund.

- How much to invest - understand your long-term return requirement and if you can give up an allocation to short-term income yield

- When to invest - we prefer to invest in a range of funds throughout the years. This way you have consistent and ongoing exposure and this diversifies the portfolio increasingly over time

- How to invest - large sums of money are no longer required to invest, instead you can now invest directly with private equity managers, who pool your allocation together with other investors to access at lower levels (e.g. USD 250,000)

- Who to invest with - manager selection is key, as you cannot sell the holding. At HSBC we focus on strategies in which we have the highest conviction, selecting what we consider to be the ‘best-in-class’ managers, who should be able to reward you for the illiquidity associated with private equity

Private equity can help you access impact investment, a growing area of focus for charities and their environmental and social considerations

Private equity can be considered an important part of a charitable organisation’s diversified portfolio, as it seeks to take a long-term approach to investing in order to deliver for future generations, whilst still balancing the needs of the present. To find out more, please contact HSBC Charities and Education team.

1 Source: NACUBO Asset Allocation Reports (23% Private Equity and Venture Capital Allocation in 2020, compared to 15% in 2009 for dollar-weighted average) ↩

2 Source: NACUBO 2020 Asset Allocation Report (reflects June 2020 data) Private Equity and Venture Capital Allocation for dollar weighted average. ↩

3 Source: Cambridge Associates “Private Investing for Private Investors: Life Can Be Better After 40(%)” Research Publication dated February 2019 ↩

4 Source: HSBC as at Q4 2020 with MSCI AC WI used for global equity markets. ↩